CaixaBank launches Smartphone TPV, a solution aimed at businesses, professionals and the self-employed of any size and sector that allows them to accept card payments of any amount from mobile devices, quickly and easily, and without the need for an additional device, as was previously necessary for similar services.

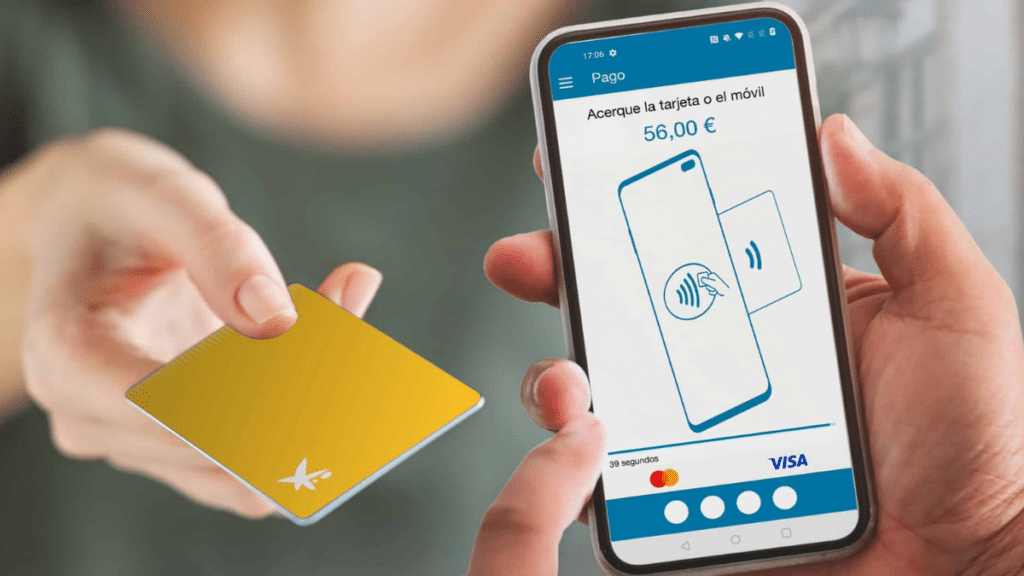

This is the first time in Spain that a financial institution has launched an app that turns a mobile phone into a POS. CaixaBank’s new application accepts contactless payments and manages them with the same security as a traditional POS. It is compatible with Visa and MasterCard cards and allows real-time consultation of the history of transactions made and the details of each one of them.

User experience that provides mobility and flexibility

With this solution, the bank helps to improve the customer’s shopping experience, which is an advantage for those businesses that need mobility and flexibility in the payment experience, such as professionals who travel to their homes to carry out work, restaurants, businesses that make deliveries, large establishments, etc.

Merchants who want to turn their phone into a payment terminal simply download the Smartphone TPV application on their mobile phone, which is now available in the Google PlayStore. The app is compatible with Android devices, both mobiles and tablets, provided they have version 8 or higher of the operating system and also NFC.

As a CaixaBank customer, on contracting the service, the merchant receives the credentials to access the application, and simply enters them in the app to start using it. When a sale is made, the amount of the transaction must be entered on the main screen and then the customer must bring the card (both physical and digital) close to the mobile phone with the app installed. If the transaction requires it, the application requests the PIN code. Once the purchase has been confirmed, the option to generate a receipt will appear and the ticket will be sent to the customer by the selected method: display it on the screen, send it by email or generate a QR code. The CaixaBank application also allows returns to be managed.

In addition, customers who sign up and want a compatible Android mobile phone will have three Samsung models available at Wivai, which they can purchase at a special discount and finance with CaixaBank at 0% APR.

CaixaBank, the leading bank in services for businesses, professionals and the self-employed

The launch of the new service will reinforce CaixaBank’s leadership in retail services, a sector in which the bank, through Comercia Global Payments, has more than 645,000 POS terminals in retail outlets and a 31.2% share of business.

Technology and innovation are key for CaixaBank. With more than 11 million users of its digital banking, the largest digital customer base in the financial sector in Spain, the bank works every day to develop new models that enable it to respond to the demands and needs of its customers and bring products, services and financial culture closer to all citizens.

Thanks to its specialisation model, CaixaBank is a benchmark for retailers, professionals and the self-employed in all types of services needed to develop these businesses. Customers are served through CaixaBank Negocios, the division that develops products and services adapted to their specific needs, with close and comprehensive advice, not only through financial support, but also by accompanying them in their day-to-day management.

This personalised service is currently offered from the 70 Store Negocios branches located throughout the country, and through the more than 2,500 managers specialising in this segment who work in the bank’s branch network. CaixaBank Businesses also has communities specialising in specific sectors such as restaurants (‘CaixaBank Food&Drinks’); pharmacies (‘CaixaBank Pharma’); and health and wellness (‘CaixaBank FeelGood’), which cater to the specific needs of businesses operating in these areas.