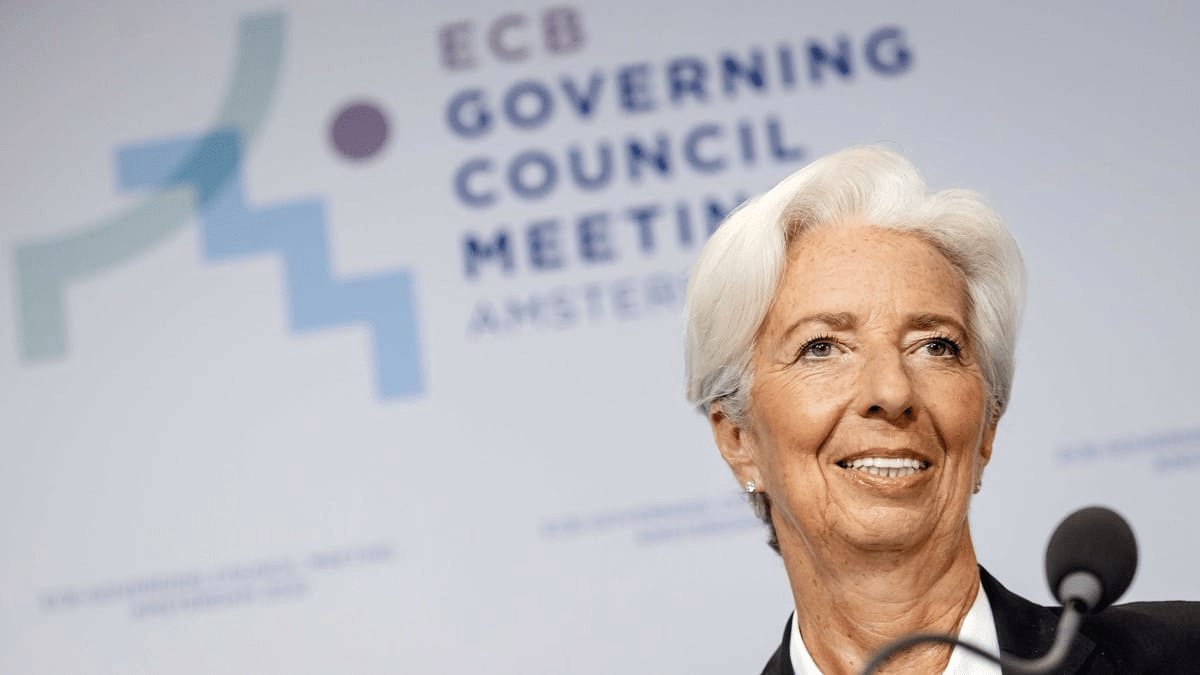

Lagarde maintains that interest rates will remain high ‘as long as necessary’.

European Central Bank (ECB) President Christine Lagarde said on Monday that interest rates in the eurozone will remain at “sufficiently restrictive levels for as long as necessary” to bring inflation down towards the 2% target.

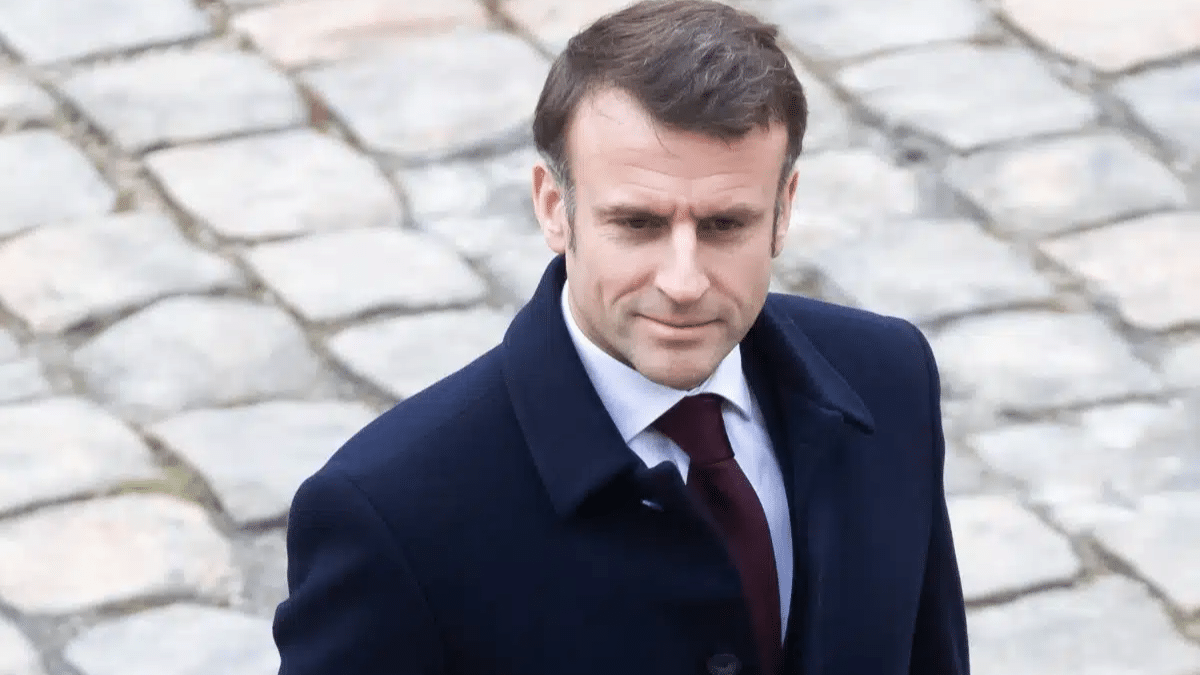

“We believe that our rates have reached levels which, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation towards our objective,” she said in a debate with the European Parliament’s Economic Affairs Committee.

Lagarde thus reiterated the message that the institution has been repeating since it decided on 14 September to raise interest rates by another 25 basis points, to 4.5% in the case of the key rate, without yet determining how long they should remain at this level.

It insisted that future interest rate decisions would depend on its inflation outlook based on incoming economic data, the dynamics of underlying inflation and the strength of its monetary policy transmission.

He stressed that future interest rate decisions will depend on its inflation outlook based on incoming economic data, the dynamics of core inflation and the strength of its monetary policy transmission.

Inflation will remain too high for too long and that is why it is necessary to keep interest rates high.

The ECB President stressed that inflation is falling, “but is expected to remain too high for too long” and noted, in particular, that “domestic price pressures remain strong”, with services inflation driven by holiday and travel spending and “high wage growth”.

It also noted that the eurozone economy is expected to weaken in the third quarter of this year, after stagnating in the first half, impacted by weaker demand for eurozone exports, tougher financial conditions and a weakening services sector.

The ECB’s latest projections lowered the growth forecast for this year and next, to 0.7% and 1% respectively, with inflation set to moderate to 5.6% by the end of 2023, 3.2% in 2024 and close to target in 2025, at 2.1%.

The ECB’s latest projections lowered the growth forecast for this year and next, to 0.7% and 1% respectively, with inflation set to moderate to 5.6% by the end of 2023, 3.2% in 2024 and close to target in 2025 at 2.1%.

On the other hand, Lagarde again called on eurozone governments to withdraw the support measures they adopted in the face of the energy crisis now that it is dissipating in order to “avoid increasing inflationary pressures in the medium term”.

Public debt, another problem

He also called on them to adopt fiscal policies aimed at “gradually reducing the high public debt” and increasing the productivity of the European economy.

In this sense, he urged to find an agreement on the rules of fiscal discipline of the European Union “before the end of the year” to have a new framework when governments have to prepare in autumn 2024 their budgets for 2025.

“If this does not happen, given the succession of elections in the member states, to the European Parliament, it is likely to be postponed and postponed for too long,” Lagarde said.