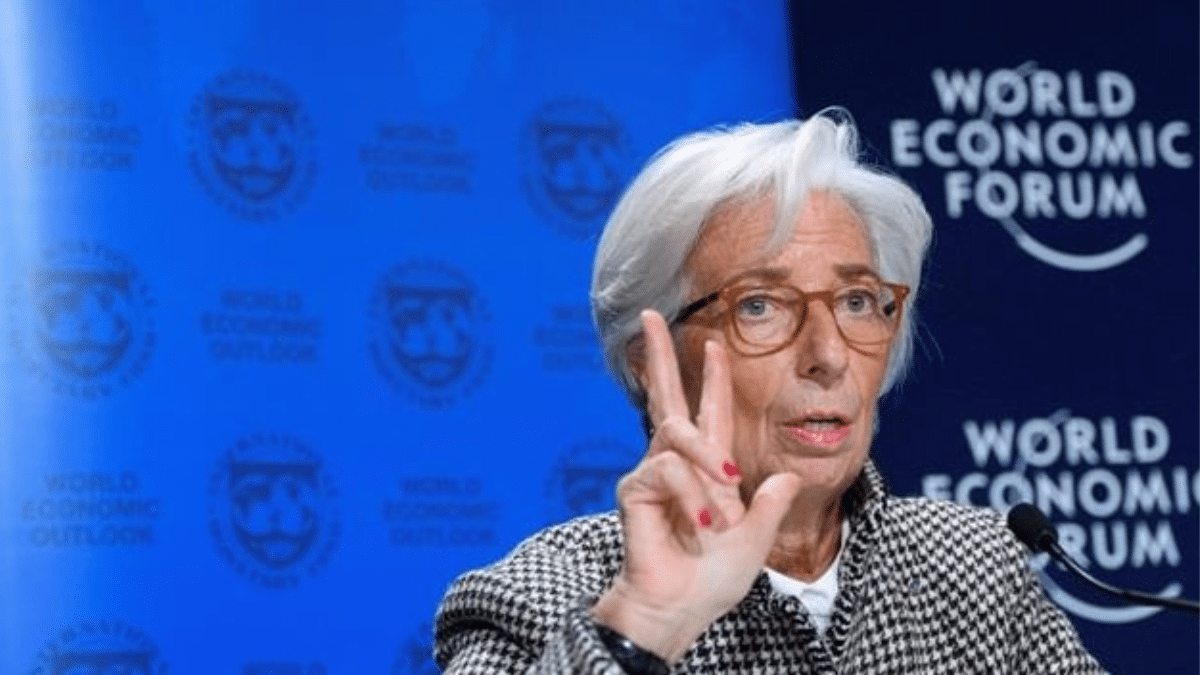

Euro rises above $1.07 after Lagarde’s hawkish interest rate comments

The euro bounced back to near $1.0750 today following improved market sentiment and hawkish comments from European Central Bank (ECB) President Christine Lagarde and dovish Federal Reserve (Fed) members on interest rates.

The euro was trading at around 3 p.m. GMT at $1.0731, up from $1.0680 in late European currency market trading the previous day.

The ECB set the euro’s reference exchange rate at $1.0697.

The mood has improved in international markets after the House of Representatives last night gave its support to the deal to raise the US debt ceiling, the legislative text now goes to the Senate, which has until June 5 to pass the measure before the country defaults on its national debt.

Lagarde said the ECB must raise its interest rates significantly more because inflation is so high.

Headline inflation in the euro area fell in May to 6.1 per cent year-on-year, down nine-tenths of a percentage point from April, and core inflation, which excludes energy, food, alcohol and tobacco, to 5.3 per cent, down three-tenths of a percentage point.

But it is uncertain how strongly the ECB’s monetary policy will be transmitted to the real economy, according to Lagarde.

Lagarde insists that the ECB must continue raising interest rates

That is why the ECB needs to continue the upward cycle until it is sure that inflation is on track to return to the 2 % target in time.

If the ECB raises rates further and the Fed pauses, the differential between the two regions narrows and so the euro rises.

Productivity in the US economy fell in the first quarter and unit labour costs rose less strongly than initially estimated.

Jobless claims rose by 2,000 last week to 232,000 from the previous week, a one-month high.

In addition, the US private sector added 278,000 jobs in May, according to ADP data, showing that the US labour market is still strong.

Fed more dovish

Fed governor Philip Jefferson, nominated for the vice-chairman position, hinted that the monetary body will probably pause on interest rate hikes at its mid-June meeting.

“Skipping a rate hike at the next meeting would allow the Committee to see more data before making decisions on the extent of additional monetary policy tightening,” Jefferson said.

The Fed committee is divided, with several members in favour of raising interest rates further but others against.

The single currency traded in a range between 1.0663 and 1.0736 dollars.