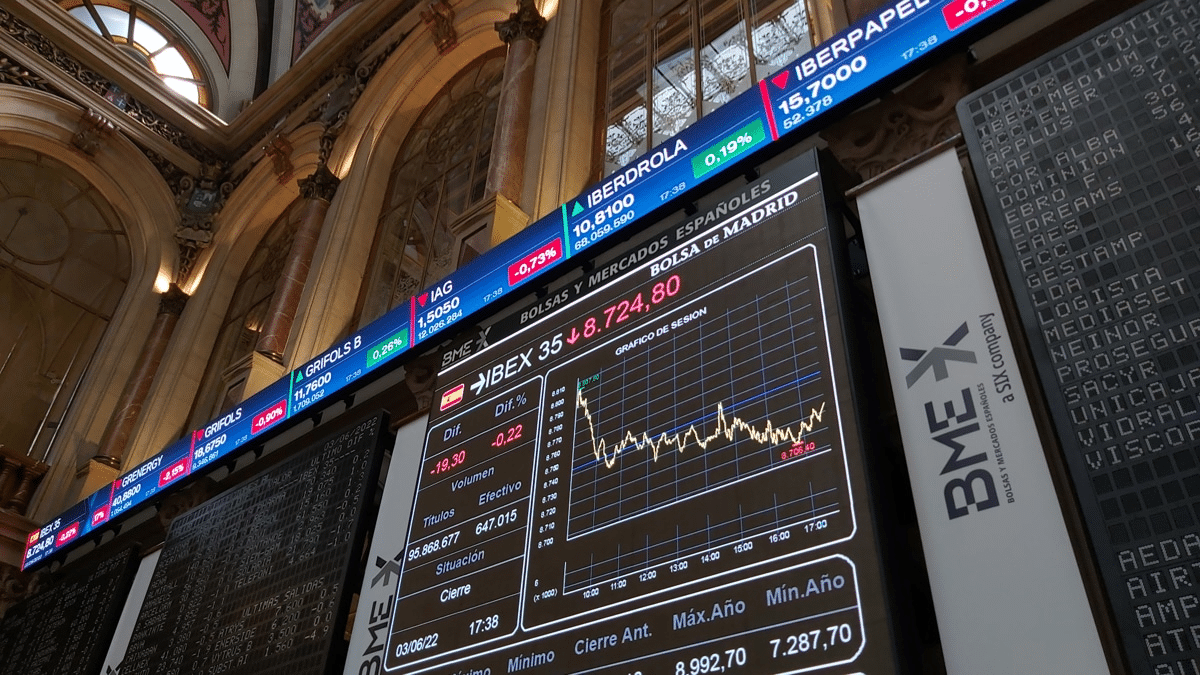

Repsol, Iberdrola and Telefónica, among the 10 worst performers on an IBEX 35 that fell 0.52%

The IBEX 35 fell 0.52% on Thursday after it was announced that, with the contraction of German GDP, the country entered a technical recession in the first quarter of the year, i.e. two consecutive quarters of negative growth. Repsol, on the day of its shareholders’ meeting, led the index’s falls, but among the 10 biggest losers on the market were Iberdrola, which fell by almost 2%, and Telefónica, which fell by more than 1.5%. Only 14 stocks closed higher. Among them, all the banks, except Bankinter, which fell 0.68%.

Its main index, the IBEX 35, has been in negative territory for three sessions in a row and today has lost 47.4 points, 0.52%, to 9,116.1 points, reducing its year-to-date gains to 10.78%, according to market data.

The selective started lower, and although at midday it settled at the level of the previous day’s close, it finally opted for losses after the disparate opening of the US indices, where the political negotiation to raise the debt ceiling continues without agreement and the GDP for the first quarter has been revised upwards.

Repsol, Iberdrola and Telefónica, three big names suffering on the IBEX 35

The large IBEX stocks have shown a divided performance: Repsol has signed the worst result of the selective with a fall of 2.8%; Iberdrola, the fifth, 1.85% and Telefónica 1.68%. On the other hand, Inditex gained 0.1 %, Banco Santander 0.43%, and BBVA, the third highest gainer, 1.2 %.

The market’s biggest gainer was Acerinox, followed by Banco Santander and Banco Sabadell. All three advanced more than 1%.

Repsol, Iberdrola and Telefónica were accompanied by Repsol, Iberdrola and Telefónica, the two Acciona, with a worse result for the parent company than for Energía, and Cellnex.