ECHR orders Luxembourg to pay 55,000 euros to LuxLeaks whistleblower

The European Court of Human Rights (ECHR) has ruled that the Luxembourg courts violated Raphaël Halet’s right to freedom of expression by convicting him for leaking documents about tax evasion in the city while he was working for the consultancy firm PricewaterhouseCoopers (PwC). It therefore ordered Luxembourg to pay Halet 55,000 euros in compensation, 15,000 euros for non-material damages and 40,000 euros to cover his expenses. Thus, according to the judgement consulted by Confilegal, the ECHR decided with 12 votes in favour and 5 against that the public interest in the information revealed to the press by Halet outweighed the professional secrecy to which he was subject, as well as the reputational damage and possible financial impact on the company where he worked and the companies involved in the scandal known as LuxLeaks.

Thus, the Grand Chamber corrects its first decision on the matter, issued in May 2021, when Halet appealed the first judgment, and decides that the sanction violates Article 10 of the European Convention on Human Rights, which regulates possible restrictions on freedom of expression and on which the French citizen’s judicial defence was based.

The ruling recognises the possible deterrent effect of upholding PwC. Halet had been sentenced in June 2016 to pay a fine of 1,000 euros following a complaint by his former company for theft, fraudulent access to the computer system, information laundering and breach of professional secrecy.

“The Court concludes that the interference with his right to freedom of expression, particularly his freedom to communicate information, was not necessary in a democratic society,” the ruling said.

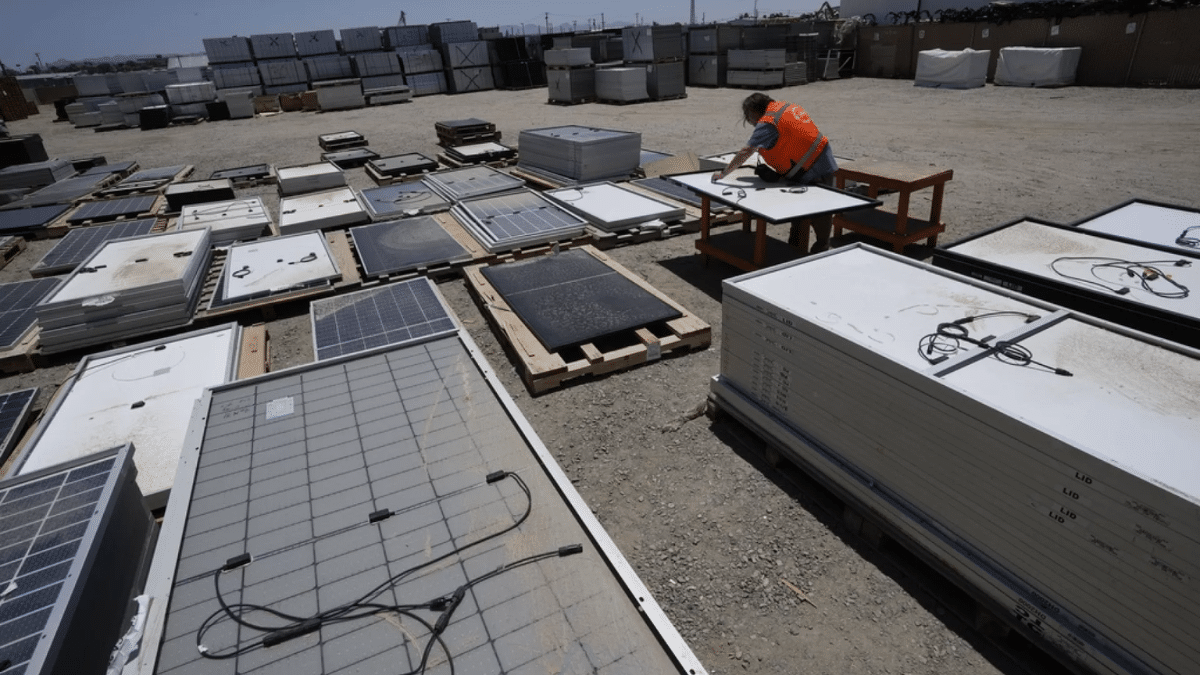

The reports, published by the French programme Cash Investigation in 2013 and in late 2014 by the International Consortium of Investigative Journalists and other media partners, revealed that hundreds of multinational companies enjoyed tax privileges as part of agreements with the tax authorities in Luxembourg, which acted as a tax haven.

The “Big 4” international consultancy companies KPMG, Ernst & Young and Deloitte, as well as PwC, were involved, advising numerous large companies, none of which faced legal proceedings. Some of the strategies revealed involved international loans and a mismatch between data from international and Luxembourg tax authorities.

The documents provided by Halet included tax returns and “pre-existing tax agreements” that highlighted apparently legal financial structures by which hundreds of companies saved millions of euros in taxes. The European Commission found that some of these tax manoeuvres, such as those used by Fiat Finance and Trade and Starbucks, constituted illegal state aid, while in other cases it did not reach a definitive conclusion.

Halet had leaked internal PwC documents to journalists together with Antoine Deltour, who, unlike his former PwC colleague, was recognised as a whistleblower by the Luxembourg Court of Cassation, thus enjoying the protection of ECHR case law.

The Frenchman described the latest ruling as a “victory” for whistleblowers and the fight against tax evasion.