Cox Energy, the renewable energy company led by Enrique Riquelme, a native of Alicante, had a successful debut on the Spanish Stock Exchange today. Its share price has experienced a significant increase compared to the agreed starting price.

At the end of its first session on BME Growth, the company closed with a value of 2.1735 euros per share, which represents an increase of 25.64% compared to the 1.73 euros established as the reference price in the Market Incorporation Document.

In this way, investors seem to support the strategy of Cox Energy, which acquired Abengoa’s assets last April in the framework of its insolvency process. However, these assets are not part of the IPO, but of another entity within the conglomerate.

At the close of trading, Cox Energy has reached a valuation of 358.4 million euros, exceeding the 285 million euros estimated in the documentation submitted to the regulator.

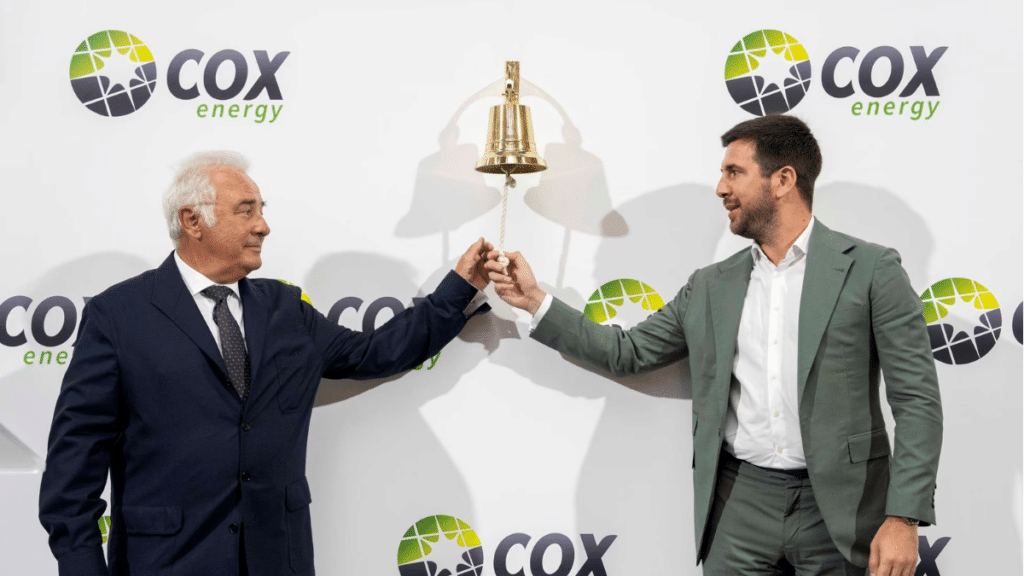

After the traditional ringing of the bell that marks the start of trading on the BME Growth, the market for growing companies on the Spanish Stock Exchange, Riquelme himself stressed that their presence on the stock market will allow them to “consolidate and expand” their leadership in the photovoltaic solar energy sector and promote a transition towards a more sustainable model.

The businessman also pointed out that its inclusion in the BME Growth will improve the company’s liquidity, broaden its shareholder base and strengthen its financial structure, thus supporting its growth and expansion. During the bell ringing, Riquelme was accompanied by Alberto Zardoya, historical shareholder of the company and former owner of Zardoya Otis.