Endesa’s board approves financial operations, which increase its debt and reduce liquidity, with Enel

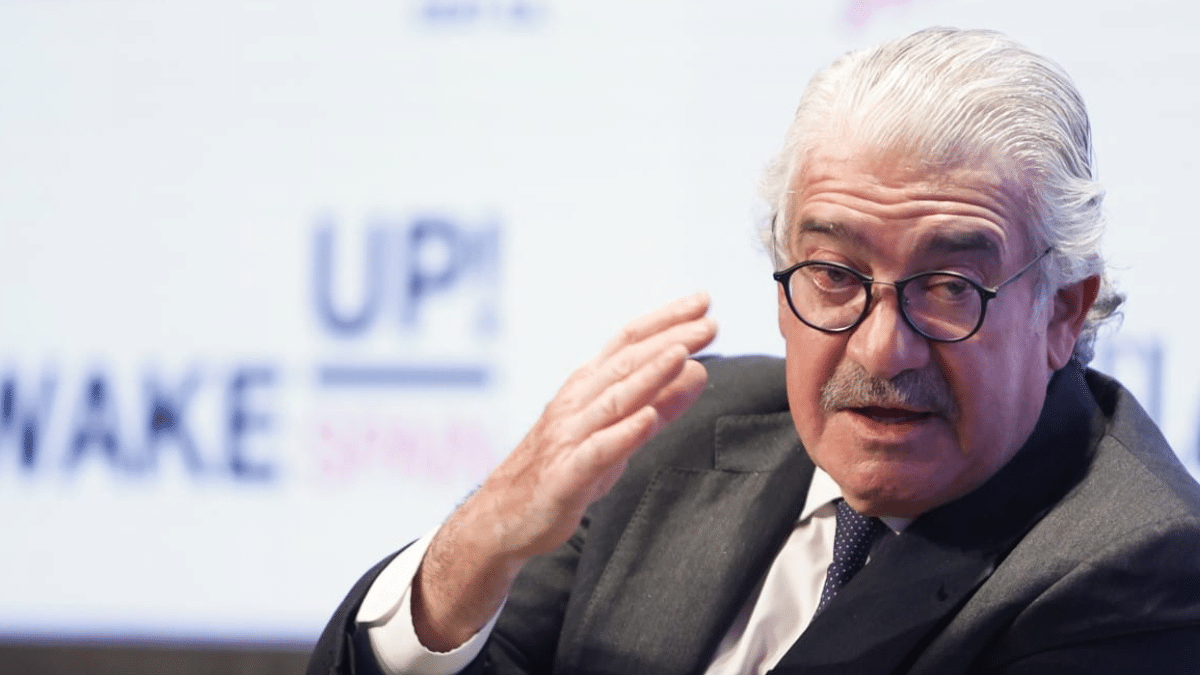

Endesa’s extraordinary shareholders’ meeting approved the items on its agenda with the support of 99.95% of the shares that exercised their right to vote, which included the formalisation of financial operations, such as a credit line and guarantees, with its parent company Enel, the Italian public electricity company, for an amount of Euro 5,000 million. José Bogas, Endesa’s CEO, acknowledges that this operation will increase the electricity company’s gross debt, affecting its liquidity.

At the meeting, held on Thursday at Endesa’s headquarters, 84.703% of the share capital was present or represented.

Endesa’s CEO, José Bogas, responded to questions from shareholders who criticised the increase in debt implied by these operations, as well as the fact that they are being carried out with the majority shareholder, Enel.

He pointed out that Endesa has decided to use the majority shareholder for reasons of “speed, cost and efficiency” to underwrite this financing, which is being done in order to be able to meet a possible increase in the guarantees required to operate in the energy markets, especially gas.

The aim is to guarantee the liquidity position in the derivatives markets in the event of future demands for new guarantees due to situations of “extreme volatility”, such as the one that occurred last August, when the price of gas soared, said Bogas.

He added that these 5,000 million will provide “great flexibility” to manage the derivative positions currently contracted as financial hedges until their settlement date.

ONE-OFF AND EXCEPTIONAL” FINANCING

Bogas said that the Enel financing that is the subject of the transaction is “one-off and exceptional”, and explained that the significant increase in collateral for financial hedging contracts and commodities has increased Endesa’s gross debt, affecting the company’s liquidity.

However, he said that the figure for collateral requirements at the end of October had fallen to 8.6 billion euros due to the gradual decline in commodity prices.

It said it expects volumes to reduce significantly as derivatives mature from 2023 onwards at a rate of around 400 million euros per month (assuming current forward prices) with a consequent reduction in debt.

Regarding the value of Endesa’s shares, he pointed out that the current share price, affected by the geopolitical context and the regulatory environment in which Endesa operates (Spain and Portugal), does not reflect its fundamentals and said that, as of today, there are no plans to buy back shares to increase shareholder value.

Endesa’s board approved the formalisation of a 12-month credit line with Enel, for a maximum amount of up to Euro 3,000 million, and the issue of an Enel guarantee on Endesa Generación bonds for up to Euro 2,000 million, until 30 June 2023.

Also, the purchase from Enel of up to 2 terawatt hours (TWh) of liquefied natural gas (LNG) by 2023 for around Euro 290 million, the renewal of the joint management agreement for LNG tankers and LNG supply contracts originating in the US for Euro 210 million, and the purchase of two LNG tankers, approximately 2 TWh, from Enel Generación Chile for around Euro 121 million.