Iberdrola’s profit rises worldwide, except in Spain, where it falls 19%

Iberdrola earned 4,338.6 million euros in 2022, up 11.7%, thanks to the positive performance of all geographies except Spain, where it fell 19% in net profit due to regulatory and tax measures and increased costs that the company says it has not passed on to customers.

As reported by the Spanish multinational this Wednesday to the National Securities Market Commission (CNMV), gross operating profit or ebitda increased by 10.2 % compared to 2021, to 13,228.1 million euros, with the United States and Brazil offsetting the negative evolution of Spain and the slowdown in Mexico.

In a 2022 conditioned by the energy crisis and the volatility of energy prices, Iberdrola increased its investments by 13% to 10,730 million euros, a historic amount, in the midst of inflationary pressures and difficulties in the supply chain.

Of this amount, 38% went to the European Union – Spain was the country that received the most with 3,000 million euros, while 1,200 million went to other countries such as Germany, France and Portugal – 25% to the United States, 20% to Latin America, 13% to the United Kingdom, and the remaining 4% to territories such as Australia.

90% of the investment has gone to renewables and smart grids to accelerate electrification and promote energy autonomy.

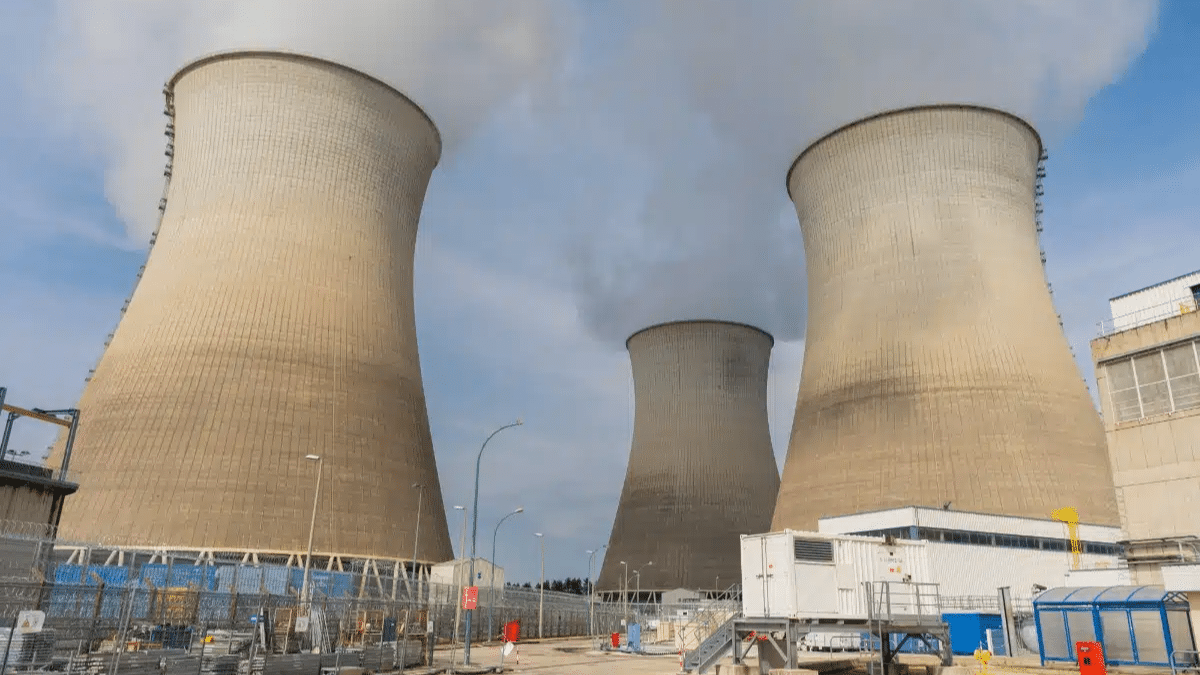

As a result of the investments already made, the group closed last year with an installed renewable capacity of around 40,000 megawatts (MW) worldwide, and 80% of its installed capacity is already emission-free.

The company also has 7,675 MW under construction that will be operational in the next four years, of which almost 3,500 MW correspond to offshore wind projects in the United States, the United Kingdom, Germany and France.

THE 2022 ACCOUNTS

For accounting purposes, net operating expenses amounted to EUR 5,209.1 million in 2022, up 5.6%, after excluding the exchange rate impact, the non-recurring effects of the asset rotation plan carried out in 2021 and the extraordinary items in the United States.

This increase was due to the growth in headcount and higher external services due to the increase in the group and inflation.

Taxes rose 112.7% due to favourable court rulings, while depreciation, amortisation and provisions grew 12.5% to 5,244.1 million euros, with a negative impact from the exchange rate.

Cash flow advanced by 25 % to 11,123 million euros, and the company has liquidity of 23,500 million euros.

The network asset base increased 19% year-on-year to EUR 39.2 billion.

This is evenly distributed between the United States, with 31% of the total, the United Kingdom and Spain, with 24% each, and Brazil, with 21%.

BY BUSINESS

By business, network ebitda rose 21% to 6,525.8 million euros thanks to the good performance in the United Kingdom, the United States and Brazil, which contrasts with the downward trend in all the figures in Spain, where it fell 1.5% to 1,608 million.

In addition, the gross margin in Spain fell by 3.6%, impacted by regulatory and legal issues.

The ebitda of the electricity production and customers business increased by 4.3 % to 6,699.2 million euros; in Spain alone, this result fell by 4.1 % to 3,460.2 million euros.

Gross margin in Spain was 5,340.5 million euros (20.2%), “considering the stable pricing policy under which the group operates, despite the high cost environment and lower hydroelectric production in the period” due to the drought.

OUTLOOK FOR 2023

In view of the 2022 results, the Board of Directors will propose to the General Shareholders’ Meeting a supplementary remuneration of EUR 0.31 gross per share, in addition to the interim dividend of EUR 0.18 gross per share paid in January.

Iberdrola expects to invest 11,000 million euros this year, which will allow it to increase its installed renewable capacity by 3,000 MW and continue to increase its network asset base, which exceeds 39,000 million euros.

With this, it expects net profit growth of between 8 and 10 % – or around 5 % including the government’s new temporary and extraordinary tax on income from non-regulated activities of large energy companies in Spain.

The multinational dedicates special mention to the group’s tax contribution, which contributed 7.5 billion euros to the public coffers of the different countries in which it operates.

Of this, 2,600 million euros were in Spain, according to Iberdrola, which defines itself as “one of the three companies that pays the most taxes to the Treasury”.